保護自己,防範未然

Credit cards are certainly a very popular payment choice, with an average of 2 credit cards held per person. But it's something that fraudsters could take advantage of.

信用卡詐騙有很多種類型,常見的例如有人在未經您授權下,使用您的信用卡來購物或套現、遺失的信用卡被盜用、以不正當手段申請信用卡、亦或盜取受害人的信用卡資料進行網上購物及交易。

以下我們為您提供多項用卡安全小貼士,保護自己免受信用卡詐騙威脅。

立即導覽至

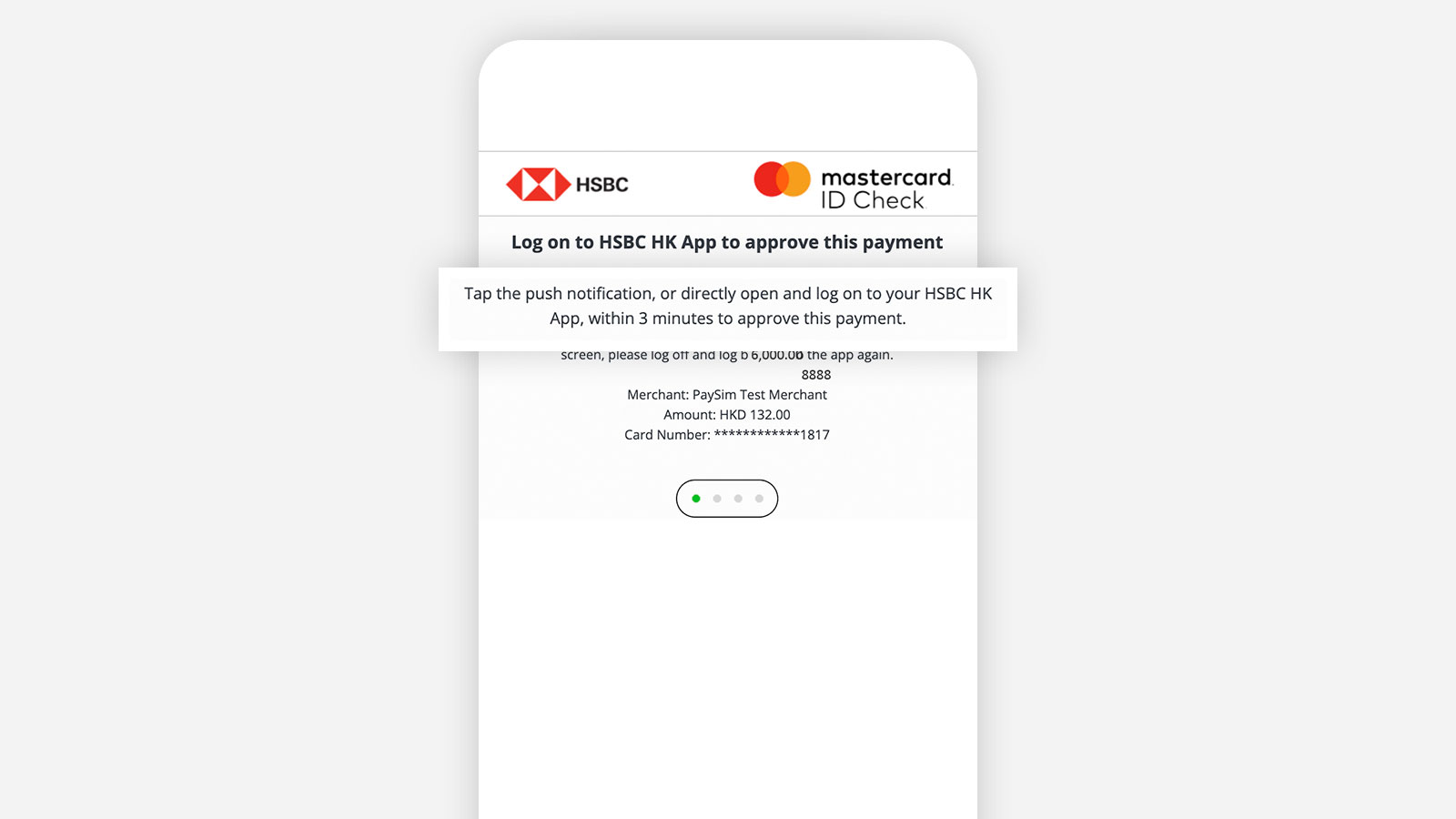

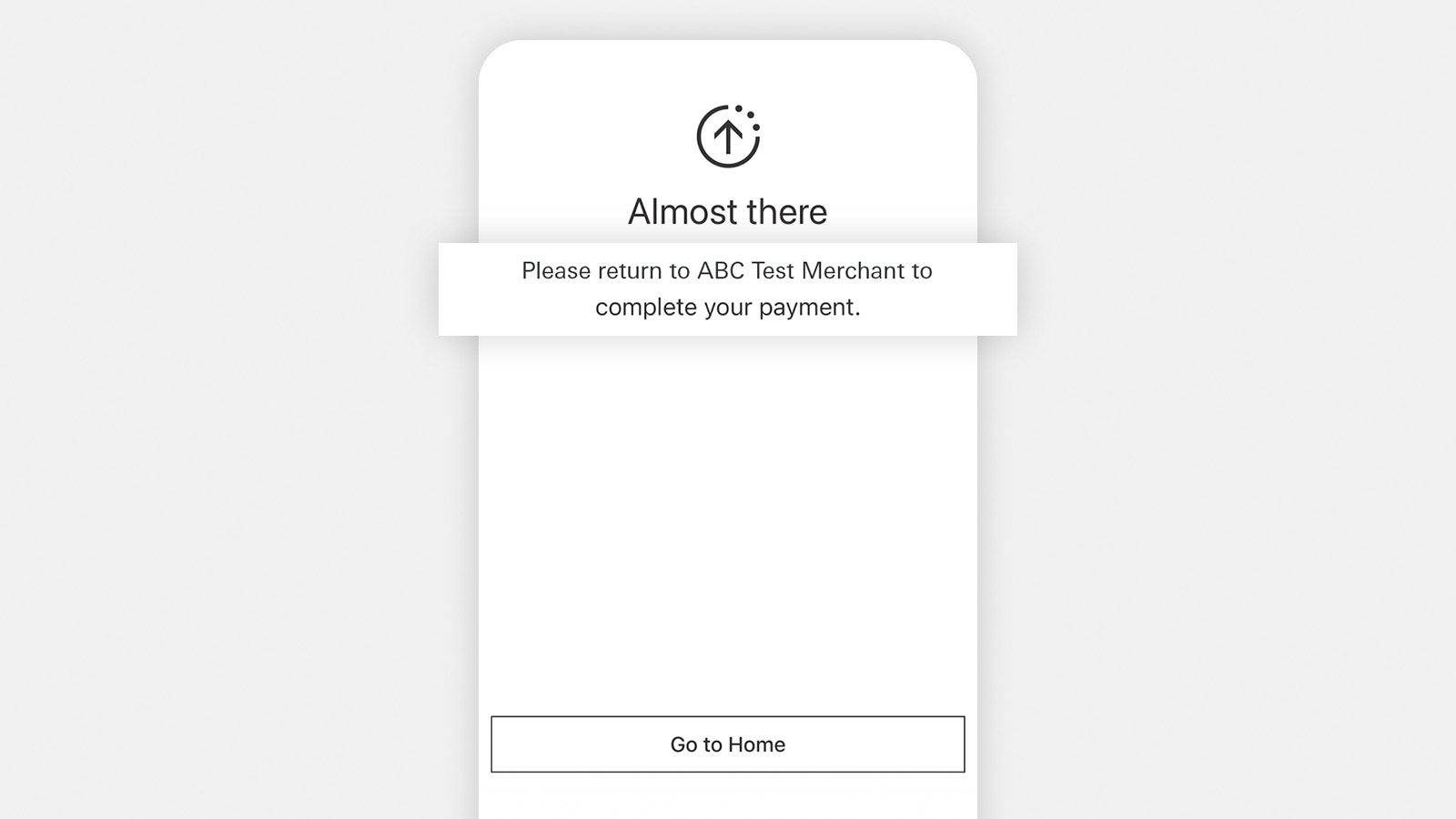

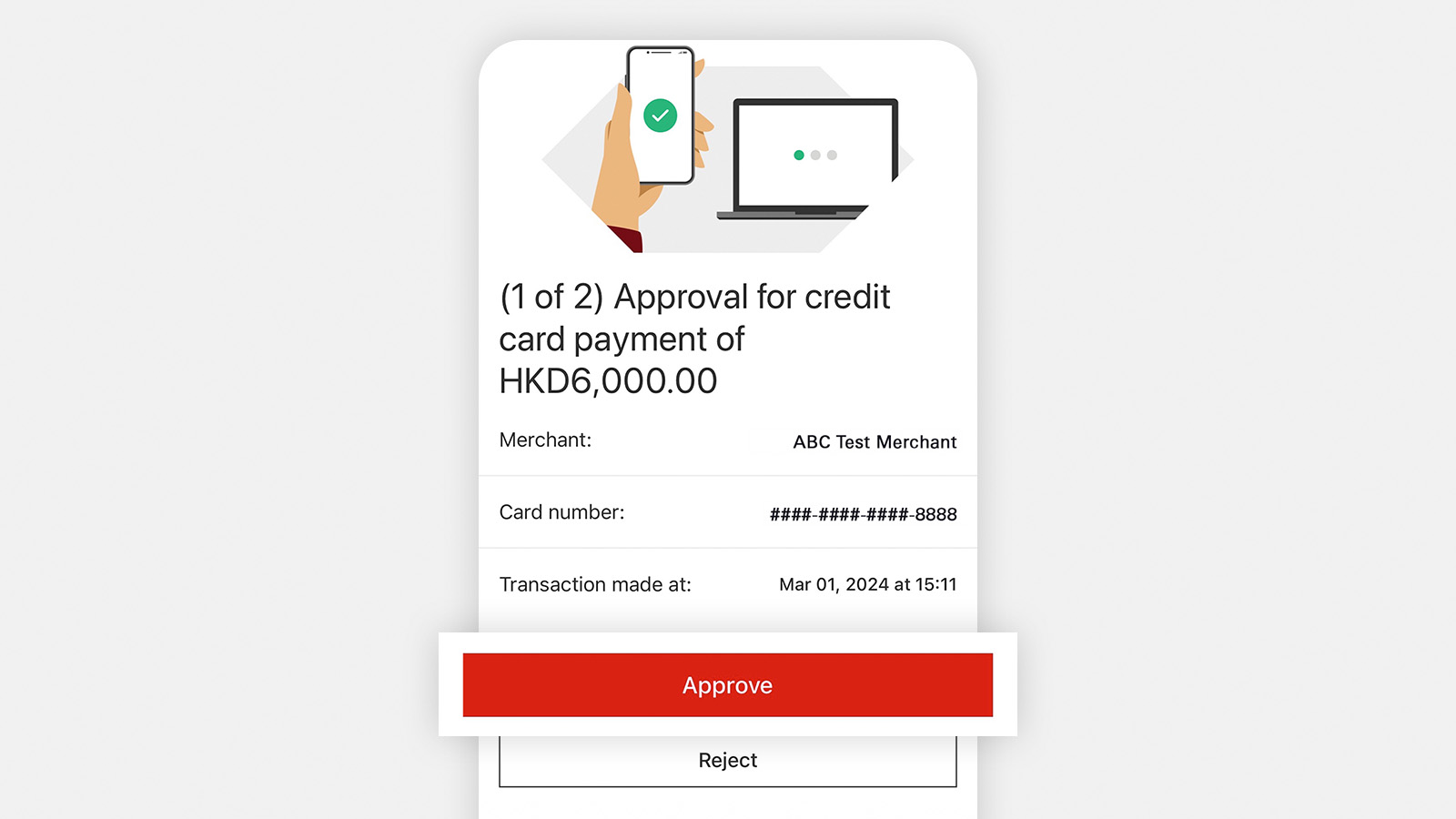

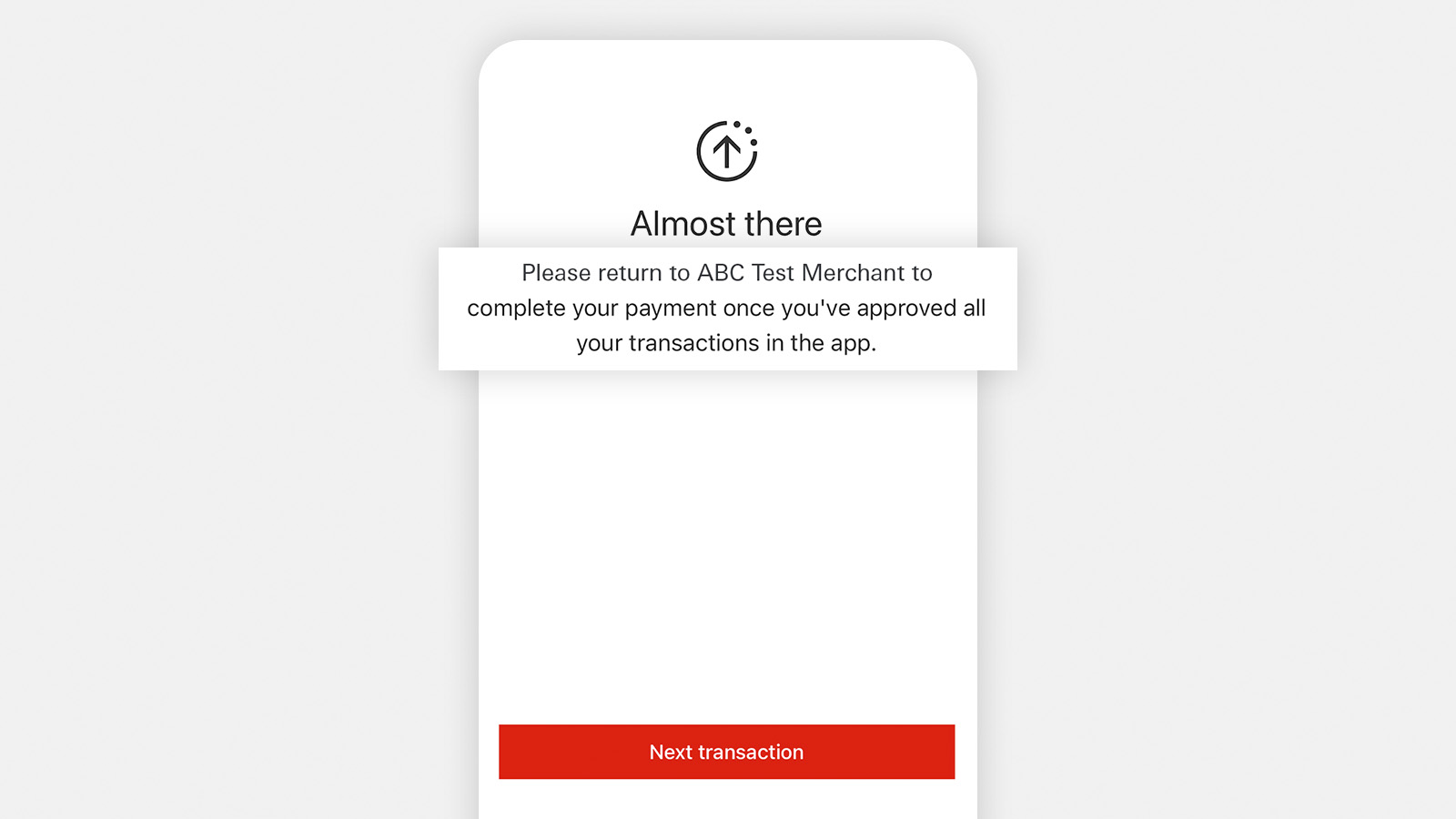

透過HSBC HK App安全認證網上交易

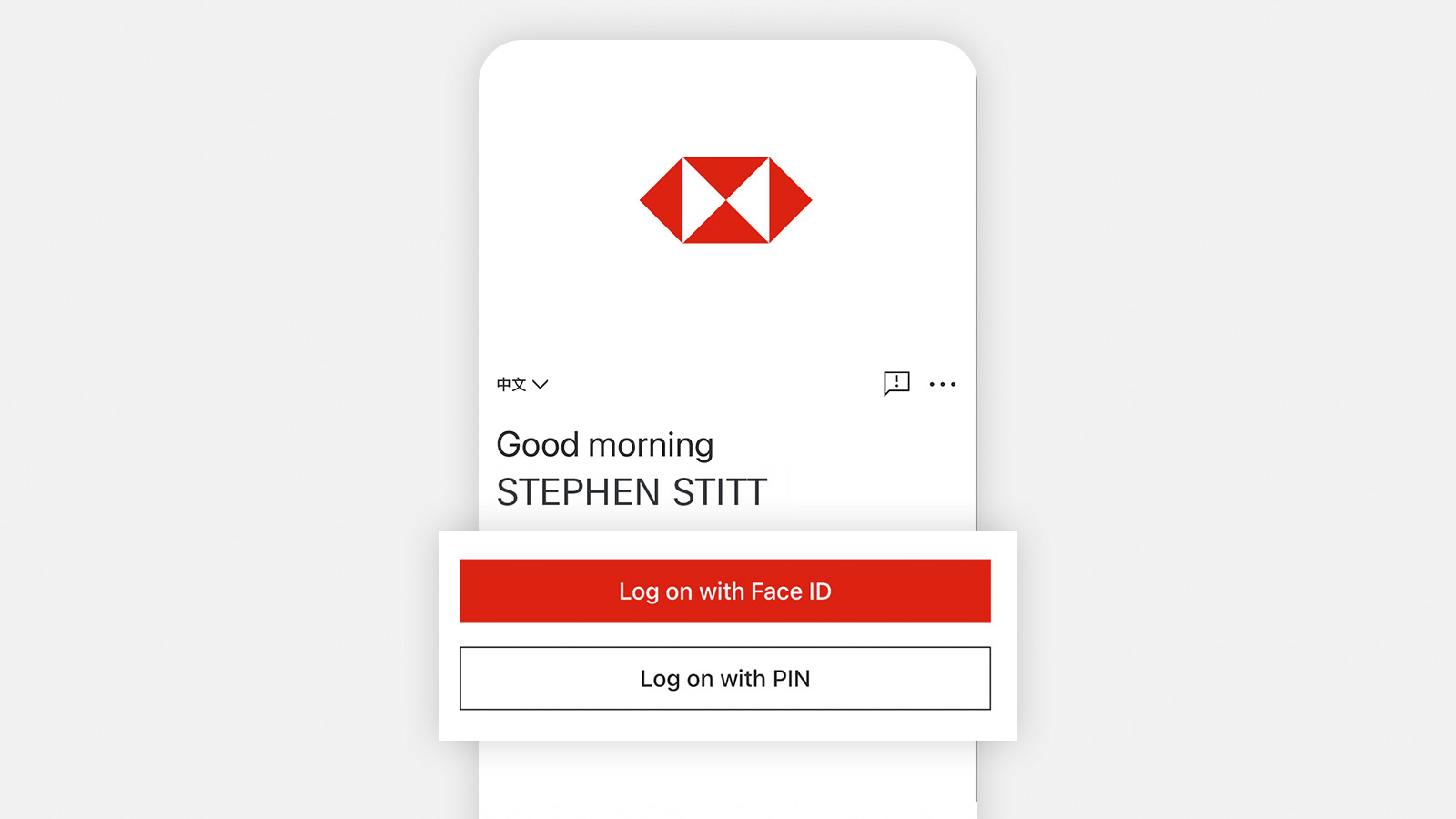

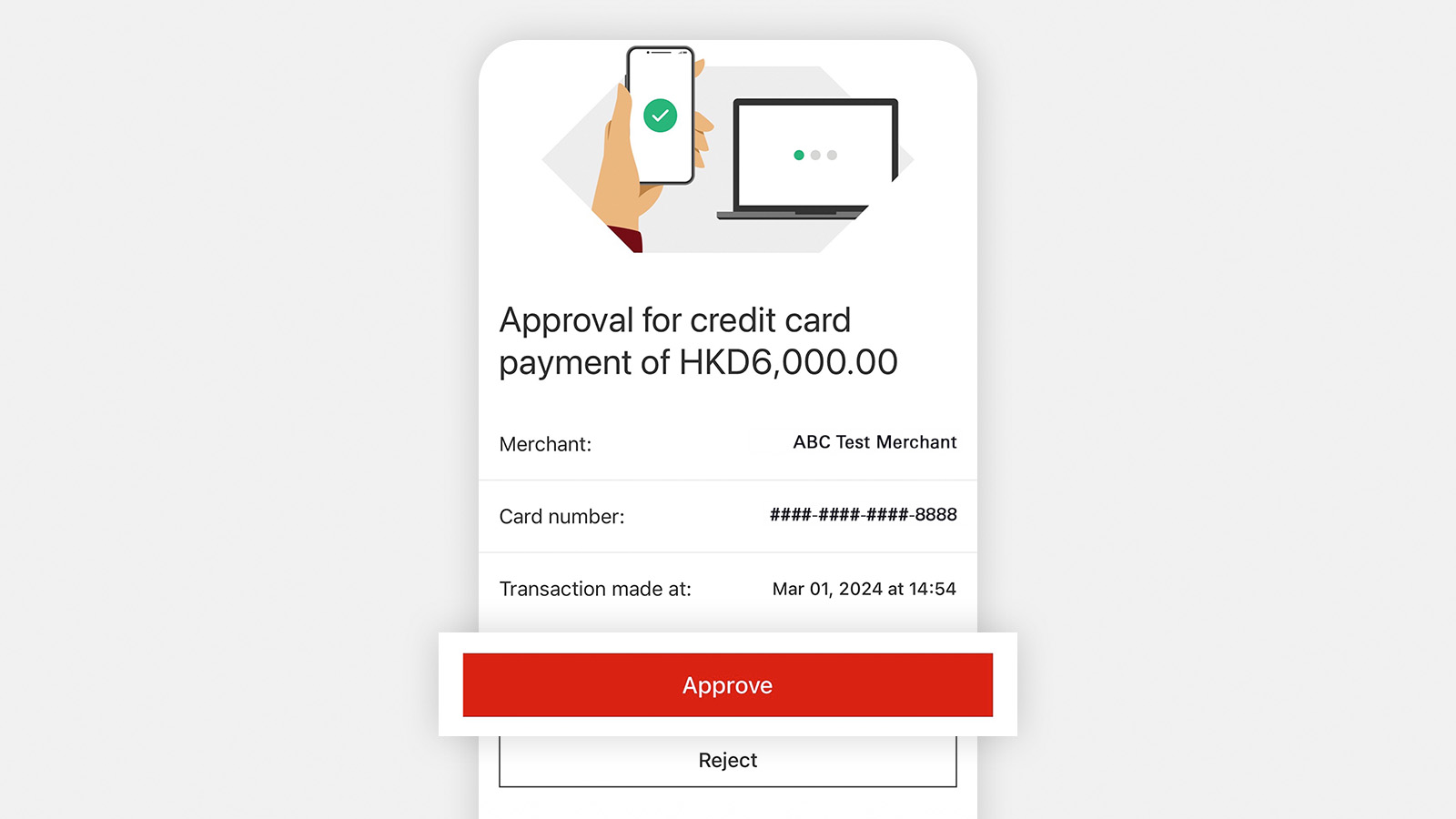

由2024年3月起,您可以使用香港滙豐流動理財應用程式網上交易認證服務,認證您的網上交易。如您已安裝HSBC HK App及登記滙豐流動理財,您毋須再以短訊收取一次性驗證碼,並可使用HSBC HK App instead of a One Time Password (OTP) sent via SMS, which is safer and more convenient.

使用香港滙豐流動理財應用程式網上交易認證服務前,請確保您已:

- updated your HSBC HK App to the latest version

- activated and verified your Mobile Security Key

常見問題

使用信用卡/扣賬卡前,多一分留心

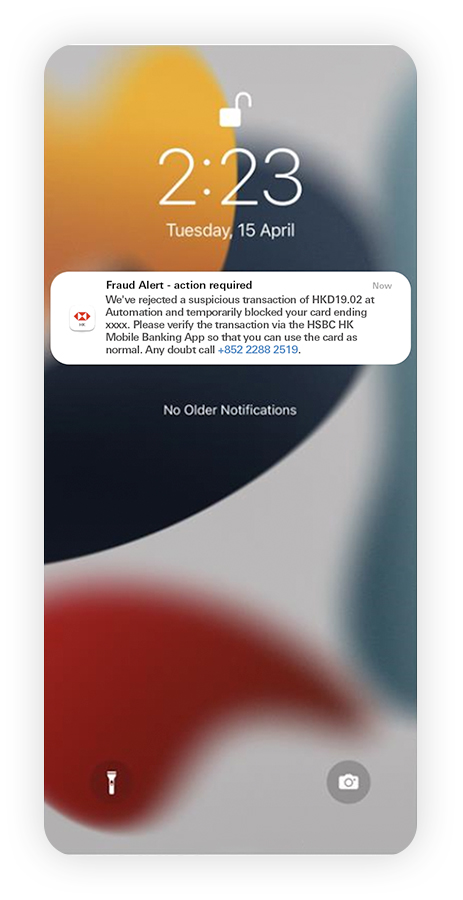

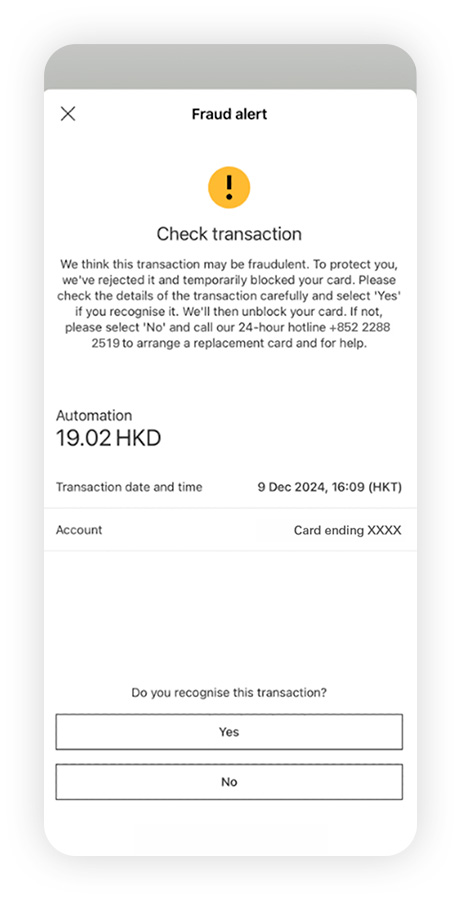

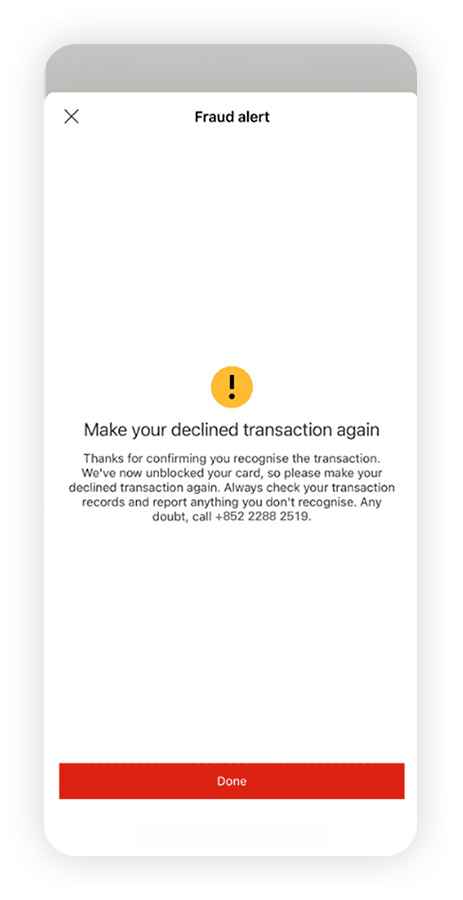

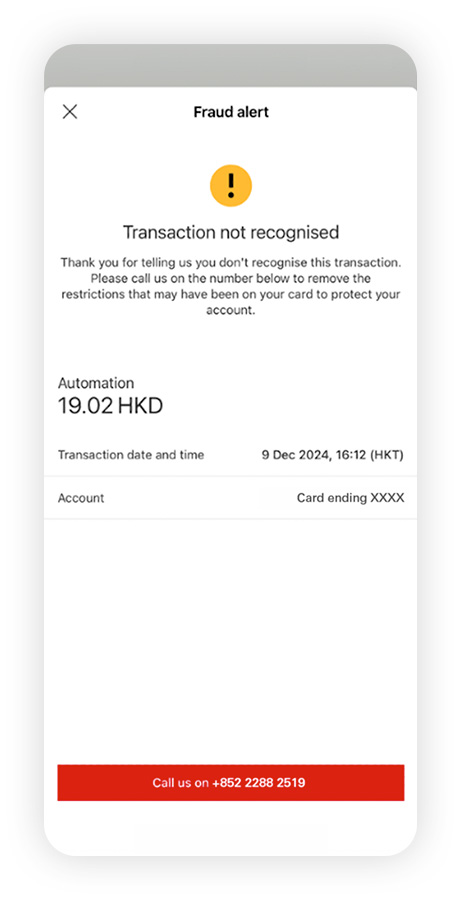

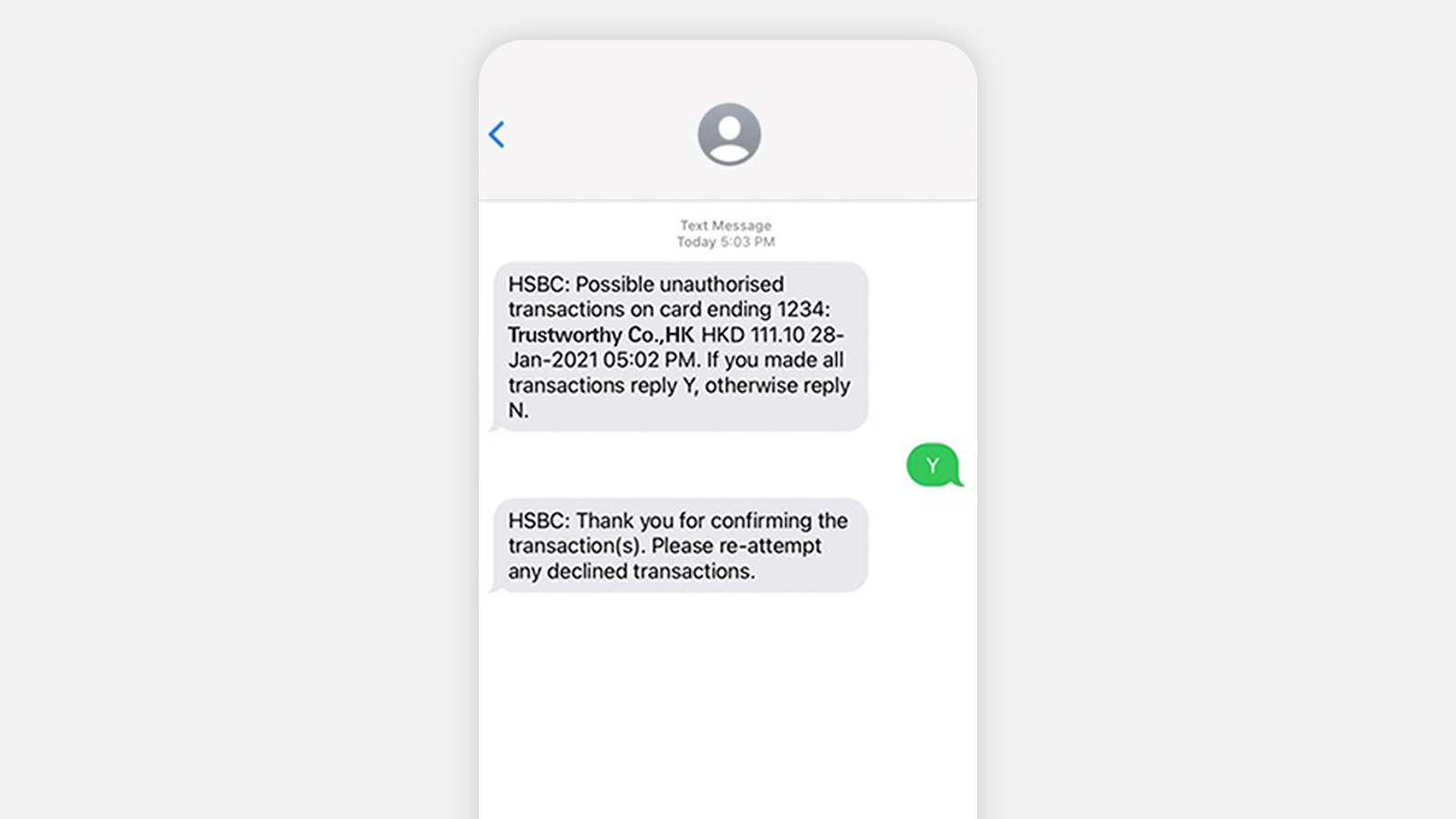

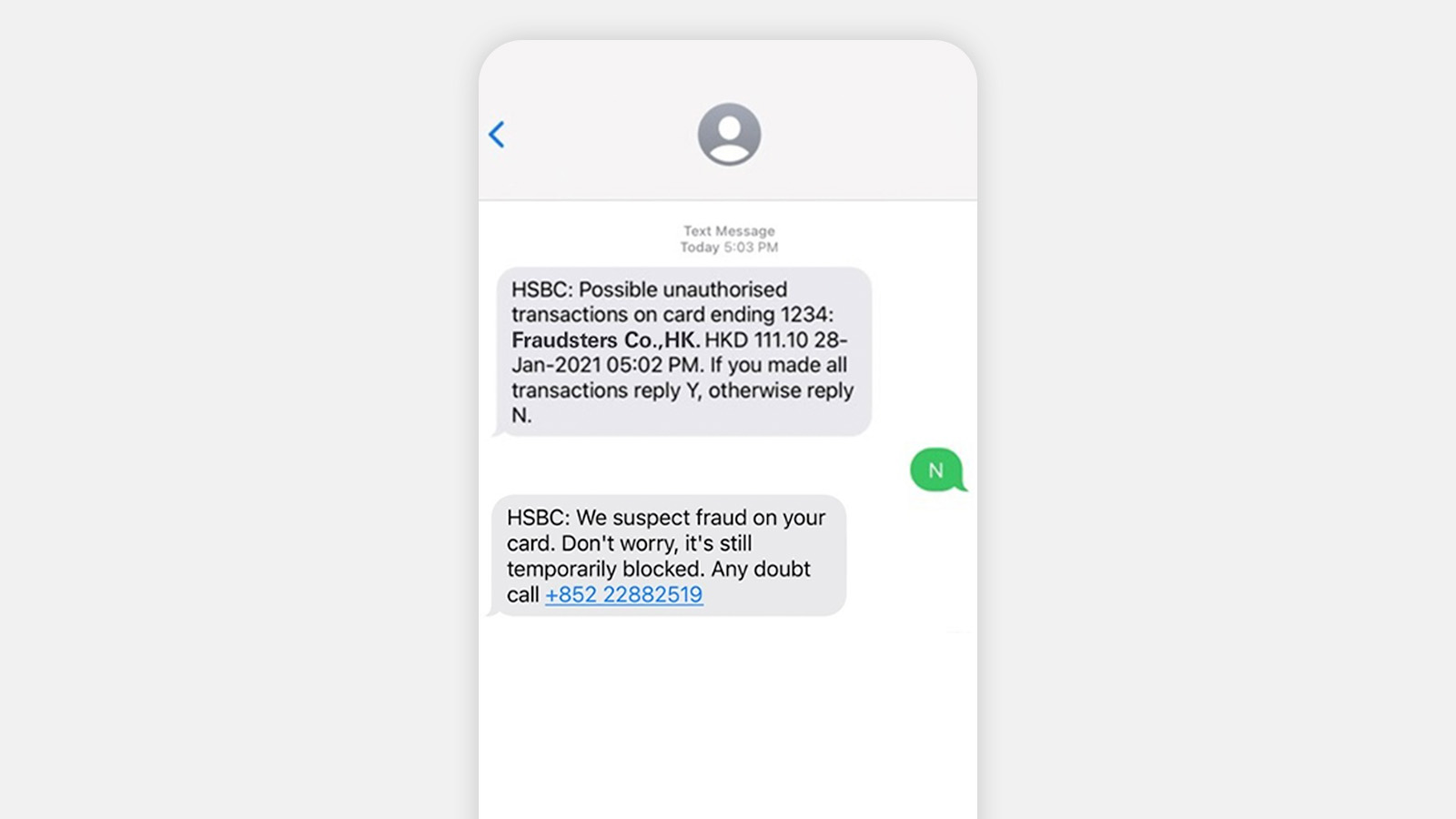

如果我們發現您的信用卡/扣賬卡出現可疑交易,就會向您發送信用卡/扣賬卡可疑交易通知。

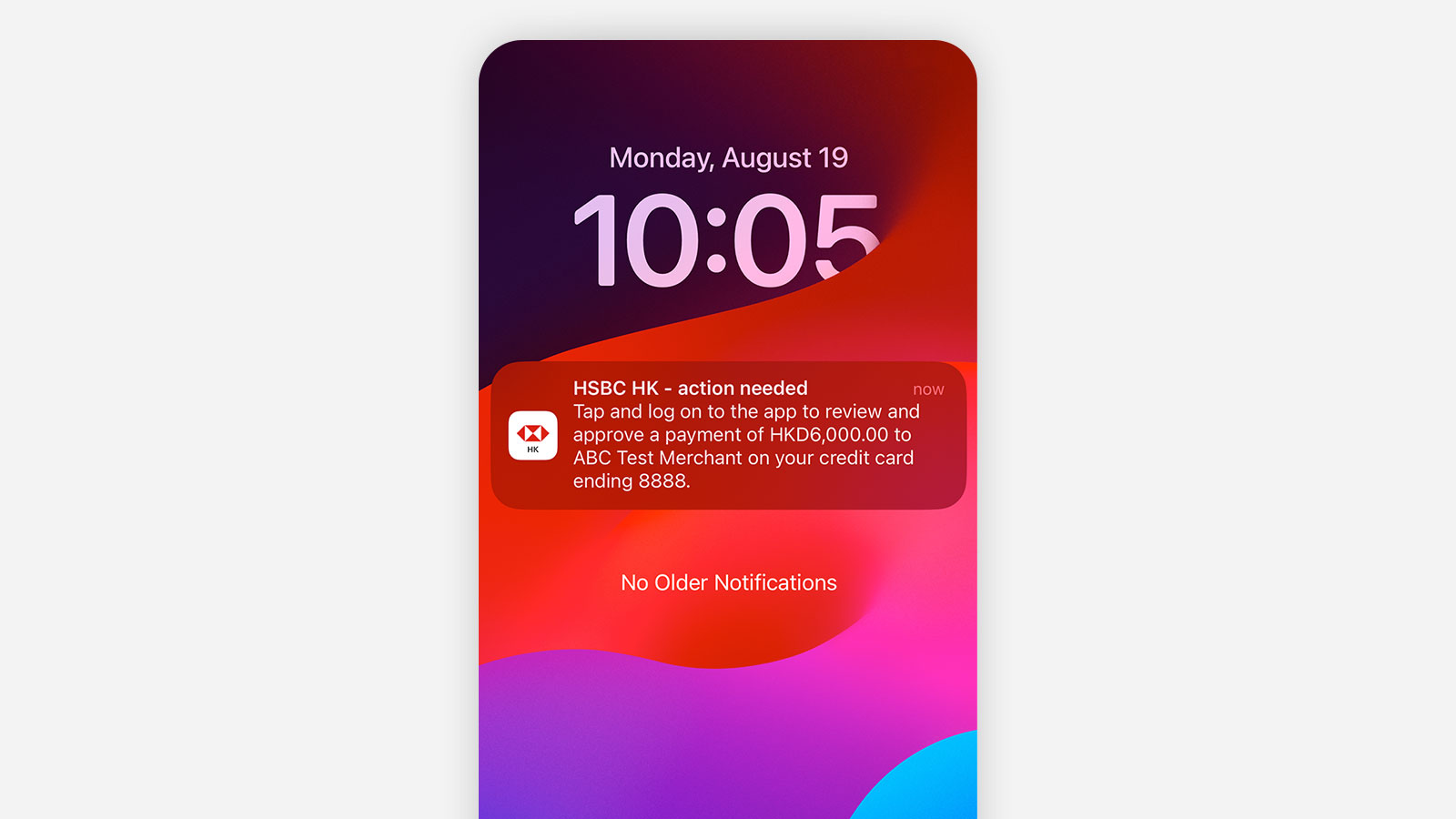

在HSBC HK App或電話短訊收到通知時,請先仔細驗證所有商戶的詳細資料、付款金額、貨幣及交易日期和時間,然後向我們確認交易是否由您本人授權即可。

信用卡/扣賬卡「可疑交易通知」怎樣運作?

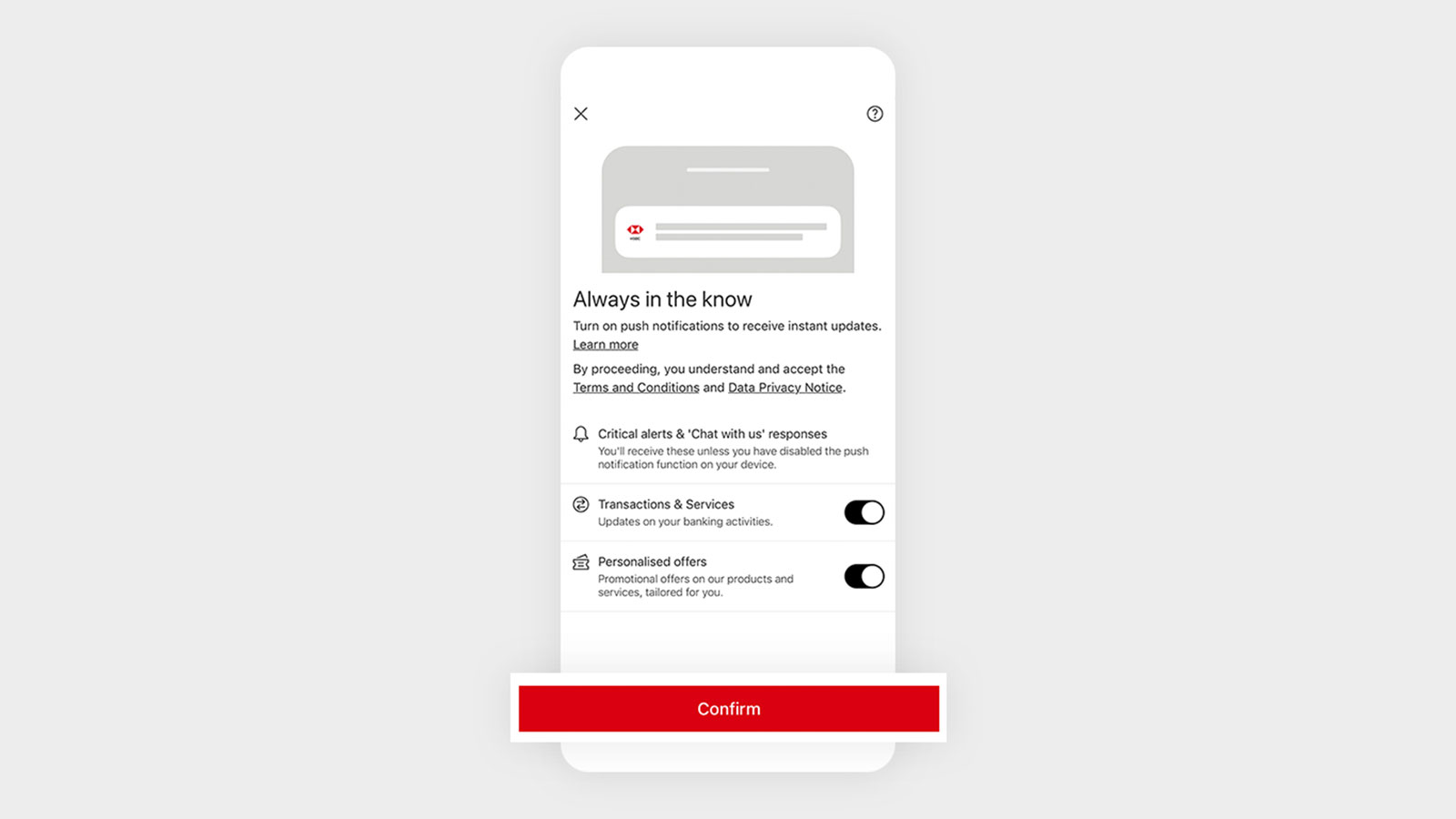

Start by turning on push notifications on the HSBC HK App

如果您已於HSBC HK App啟用接收推播通知功能,您將收到付款確認通知。

否則,請按照以下步驟在HSBC HK App中啟用推播通知:

- Select the menu icon, then the profile icon.

- Find 'Settings and preferences', then select 'Communication preferences'.

- Use the toggle to switch on push notifications for 'Transactions & Services'

使用信用卡/扣賬卡時,提高警覺性

-

確保網購平台安全可信

網址應該以「https」開頭,網址欄亦會顯示掛鎖圖案。 -

以更安全可靠的方式認證網上交易於支援有關服務的網上商戶進行交易時,您可以使用香港滙豐流動理財應用程式網上交易認證服務,更安全便捷地認證您的網上交易,毋須再以短訊收取一次性驗證碼。

-

清楚檢查一次性密碼短訊

When you receive an OTP (one-time passcode) from HSBC, don't just look for the 6-digit code and rush to act—check other essential information including the merchant name, transaction time and amount so you can be sure you're authorising the correct transaction. -

定期查閱信用卡/扣賬卡賬單

Log on to the HSBC HK App regularly or review your card statements and the transactions in it carefully. Make sure that you recognise each transaction made. -

千萬不要透露敏感個人資料

Don't share your banking credentials, no matter how tempting the offer may seem. Fraudsters may impersonate real organisations and use phishing SMSes, emails, fake websites, bogus calls or malicious links to trick you into sharing sensitive information such as your card number, CVC/CVV number or OTPs.

發現可疑交易,即通知我們

See a transaction you don't recognise? Don't worry, you can place a temporary block on your card while you double-check your records or file a report with us.

暫時封鎖信用卡/扣賬卡

如果您遺失信用卡/扣賬卡,或者懷疑信用卡/扣賬卡被盗竊或盗用,您可透過滙豐香港流動、網上理財應用程式或致電我們的客戶服務熱線封鎖信用卡/扣賬卡。

您亦可致電我們的客戶服務熱線報失信用卡/扣賬卡。

想知更多如何封鎖信用卡?您可以瀏覽滙豐香港網站 > 查看常見問題、表格及服務費用 > 信用卡/扣賬卡支援 > 報失或封鎖您的信用卡

如果發現信用卡/扣賬卡出現可疑狀況

,或者有未經您授權的交易,請立即向我們回報。

滙豐環球私人銀行客戶: (852) 2233 3033

滙豐卓越理財尊尚客戶: (852) 2233 3033

滙豐卓越理財客戶: (852) 2233 3322

其他個人理財客戶: (852) 2233 3000

註

-

如您尚未登記滙豐流動理財,或安裝HSBC HK App並啟動及驗證流動保安編碼,我們會繼續透過短訊發送一次性驗證碼至您登記的手提電話號碼,以驗證您的網上交易。

- You should ensure that your mobile phone and other telecommunications equipment and related services are capable of receiving Push Notification Alerts through push notifications.

- Push notification runs on the service provided by Apple Inc. ("Apple") or Google LLC ("Google"), as applicable. Any delay or failure in delivering push notification messages due to Apple's or Google's service is beyond our control.

- Apple, the Apple logo, iPhone, iPad, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc.

- Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

- The screen displays are for reference and illustration purposes only.